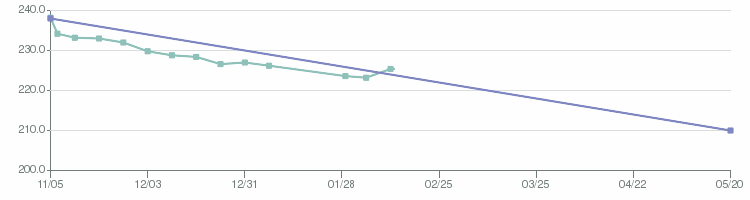

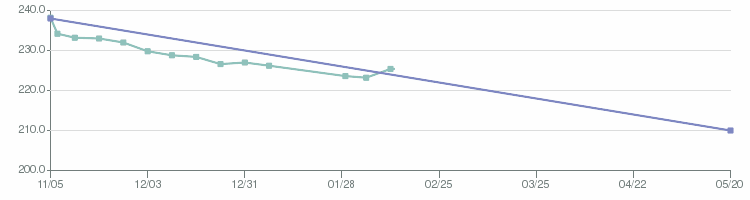

Last April, Kathy and I performed a comprehensive review of our finances. We discovered that we had allowed our consumer debt to slowly increase, month after month, to the point that we owed nearly $20,000 on various credit cards. Although we own both of our aging vehicles ‘free and clear’, we had made a practice of living above our means on a monthly basis. In just a few years of self-indulgence, we grew our indebtedness into a substantial millstone, hanging around our necks.

Our debt seemed mountain high.

“We’ve got to do something,†Kathy implored me.

My wife is the more fiscally-conservative in our marriage. Debt bothers her more than it does me, and (although she can spend some serious money at a Target sale quicker than you can say “50% offâ€) she inherited many good financial habits from her thrifty parents.

Although I also am blessed with parents who are frugal, money has sometimes come easily to me, and so I can be a little cavalier about it. “Easy come, easy go,†I sometimes think. Blessed with the gift of generosity, I don’t always draw a clear distinction between giving to others and giving to myself.

Over the past ten months, we have seen the hand of the Lord time and time again in the area of finances. In spite of unexpected expenses and repairs, we’ve made steady progress on reducing our indebtedness. Each time that we have faced a hurdle in expenses, God has provided a way to overcome that difficulty without going further into debt.

Finally, the day arrived: our tax refund was deposited into our account, and we were able to pay off the last of the remaining debt.

Our debt is finally gone, after eleven months of God’s goodness!

As soon as I woke up, I fired up my computer to check to see if the promised deposit was there. “Did the money arrive?” Kathy asked, before I had finished logging in.

“I hope so … hold on … YES!” I checked again, just to be sure.

We gathered the kids and I let Kathy push the ‘Continue’ button on the funds transfer. “As of this moment, we don’t owe anyone anything except for mortgage debt,” I announced. Technically, I was wrong, since we still have another kind of debt:

Owe nothing to anyone except to love one another; for he who loves his neighbor has fulfilled the law. — Romans 13:8

Kathy and the kids trundled off to co-op, but I found my mind circling back to this startling truth: we don’t have any more debt hanging over us! It felt strange, as it does when you’re in college and your last paper is turned in and your last final is complete, and Summer Break has begun.

My mind turned to consider the parable of the lost coin. In Luke 15, Jesus tells a story about a woman who loses a coin, and then finds it again:

Or suppose a woman has ten silver coins and loses one. Does she not light a lamp, sweep the house and search carefully until she finds it? And when she finds it, she calls her friends and neighbors together and says, ‘Rejoice with me; I have found my lost coin.’ In the same way, I tell you, there is rejoicing in the presence of the angels of God over one sinner who repents.”

We thought about having a party, and inviting all the people we know, to rejoice with us. Not to boast, but simply to celebrate. It wouldn’t be a fancy party (since we’re staying on a budget), but it might be an opportunity to encourage others. “If Tim and Kathy could do it,” people might say to themselves, “then surely anyone can get out of debt.”

Not our actual party. A Valentine’s Day tea party.

So we’re having a party.

‘Open House’ format, from 4 pm to 8 pm on Saturday, March 7th. Games, fellowship, food and fun.

If you read this blog and know where we live, consider yourself invited. Come, rejoice with us!

We won’t make you wear the party hat unless it’s your birthday.

Please bring something tasty to share, and also write down (on a 4 x 6 card or something) an idea you have used to help save money (or avoid spending it altogether). We’ll compile the ideas, print ‘em out and make them available to the contributors, sort of like compiling a stewardship cookbook.

A time to celebrate!

Tim