A little more than a week ago, I posted a blog which I whimsically entitled Daylight Savings Time. A rather feeble play on words, I attempted to explore an innovative new idea I discovered: saving money and getting out of debt. I was astounded by the number and quality of responses we received in the form of comments and personal e-mails. It turns out that a large number of people are rather passionate about this subject.

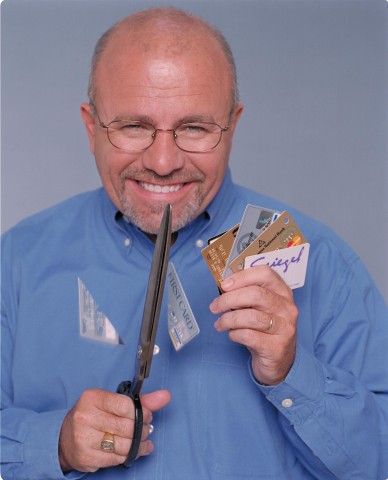

Not one of our actual readers.

“Whoa, there,” I thought. “Most of these people are serious about paying off debt. Some of them think we should actually get rid of our credit cards!” I pulled up a browser window and shopped a while at NewEgg.com until I regained my composure.

Let’s face it: I like having credit cards. I like the feeling of power they engender, and the illusion of value and wealth. I enjoy the convenience and the ease with which I am separated from my money. I value the increasingly-worthless airline miles I earn when I engage in serious borrowing. I even like the mail they send me:

“Dear Tim,” they write. “We’ve noticed that you haven’t reached full indentured-servanthood yet, in terms of the amount you owe us, which is slightly less than Argentina owed to the World Bank in the late 90′s. To tempt you to be even more irresponsible, we’re raising your credit limit to ridiculous levels. You should rush out and buy a computer for every room in your house!”

As we read comment after comment, extolling the virtues of Dave Ramsey’s books and Crown Financial Ministries, we began to feel a bit convicted. “Maybe the time has come for us to actually make a change in how we handle our money,” I mentioned to Kathy, rather hesitantly.

One of the Small Groups at our Church is doing a study using Crown Financial’s book …

“Sounds great! When shall we start? I’ve got our old budget (the one we started last year) right here! I’ve read three chapters of Ramsey’s book, and I have a list of things we need to talk about!” My wife is nothing if not enthusiastic.

I dragged my feet for a week or so, ’cause I like to play hard-to-get, but eventually she wore me down, and I agreed to spend a couple of hours talking about our financial future.

“I’m so excited,” Kathy bubbled. “My friend M. and her husband sat down the other night to talk finances, and they got into a big fight. I’ll bet we can do even better!”

Sure enough, we had a big fight about parenting before we even started talking about money, which demonstrated our superiority and, I felt, put things into their proper perspective. We came to a few tentative conclusions:

- We need to stop using credit cards

- We must build a workable budget that allows us to live within our means, and stick to it.

- We should aggressively seek to set aside $1000 as an emergency fund, so unexpected expenses don’t ‘break’ our budget, or lure us back into deficit spending.

- Once we’ve got the $1000 put aside, we can attack our smallest debt and work to pay it off as quickly as possible.

Dave seems to have an answer for everything.

The more I thought about it, the more I realized that this is not going to be a quick or easy path for us. To follow these simple steps, Kathy and I will have to change quite radically. We’ll have to learn to defer gratification, and to find joy in paying off debt, rather than in the acquisition of ‘stuff’. We’ll have to temper our generosity, and live under actual constraints. We’ll have to learn new vocabulary, as in “We can’t afford that right now,” or “We’ll buy that just as soon as we save up for it.”

“Afford? Saved? What do those words mean, Dad?”

It will probably come as no surprise to those who have been down this road, that even now, as we stand on the brink of making a decision to change our way of life, we are facing some considerable expenses:

Not my actual tooth.

- I’m in the middle of an implant process for one of my teeth that will probably cost me another $1800, after insurance

- Kathy faces a potentially costly dental process in the near future (cost unknown)

- Our van badly needs new brakes and other maintenance (ballpark $600)

- We urgently need to replace the roof on our house (probably around $14,000)

- We are in need of some homeschooling materials by the end of the summer ($600)

Not my actual roof.

So, what would you advise?

(1) Shall we abandon our well-intentioned, but naive attempt to shake off our dependence on debt?

(2) Shall we satisfy these immediate costs, and only then embark on a course of correction (admittedly, with a much higher debt load)?

(3) Shall we stick to our guns and refuse to go further into debt, even if our safety, our health and the value of our home may suffer as a result of deferring these expenses?

(4) Shall we take some drastic step (sell our house & move back to the country, change jobs, get a second job) rather than accept additional debt?

(5) If we do borrow money to get through these expenses, can I sneak in the purchase of a new computer, since it would be such a small proportion of the money borrowed? (Well, OK, I think I know the answer to that last question.) ![]()

Examining my heart, I really don’t know if these are smoke screens or not. Each of the expenses seems ‘necessary’, and my spirit quails at the prospect of abandoning the alternative of credit (I’m afraid I’ve leaned on credit too long). Do I just need to trust in God to provide for each in turn, or is this a case where I can’t reasonably expect God to bail me out from a series of bad decisions? After all, it isn’t God who borrowed money to acquire ‘stuff’, and who failed to save for these kind of expenses. The roof, for example, is certainly not unexpected — we’ve known since we bought this house that we needed to replace it. Is it reasonable to live for years beyond my means, and then, suddenly, when I finally get the courage to change, to expect God to save me from the consequences of my misconduct?

She makes climbing look so easy …

These are serious questions. I value the wisdom and encouragement of the many responses we received from the first blog, and I’m hoping that some of you will take a few more minutes to offer your insight.

Tim